If you need help, here is a sample letter to help you express your concern:

Dear Senator Britt,

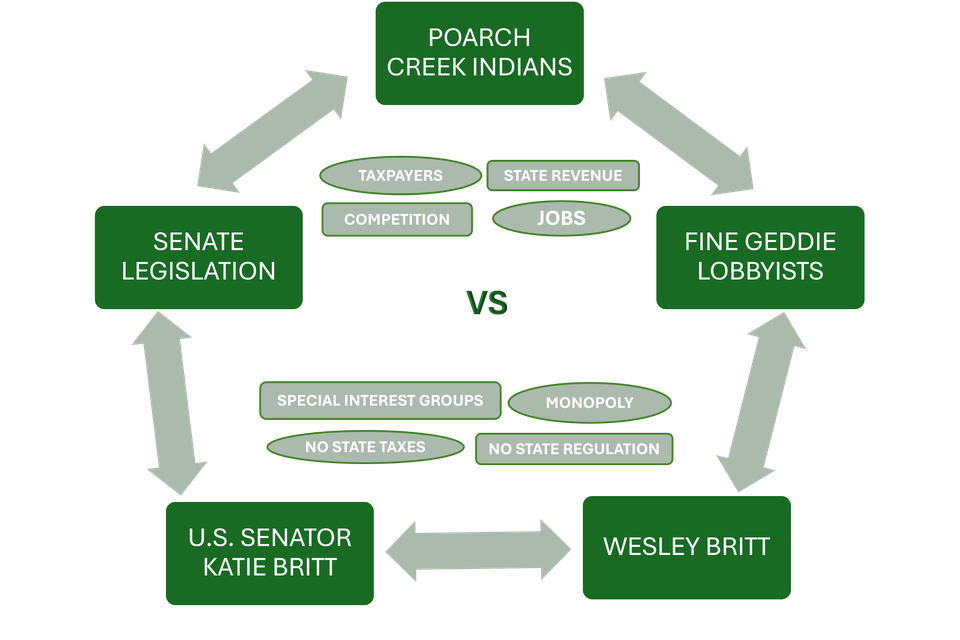

Thank you for your dedication to representing the people of Alabama and your efforts to address important issues affecting our state. As a concerned taxpayer, I am concerned about how the Poarch Band of Creek Indians Parity Act (S.3263) could impact Alabama taxpayers and businesses.

As you know, The Poarch Band of Creek Indians already operates gaming facilities in Alabama that are exempt from state taxation and regulation. While these operations generate significant revenue, the state of Alabama and its taxpayers see no financial benefit in the form of taxes or revenue sharing. If S.3263 allows for additional lands to be taken into trust, it would further entrench this system, leaving Alabama taxpayers to shoulder the burden of funding critical services without contributions from these profitable enterprises.

Additionally, this bill would grant the Poarch Band an even greater competitive advantage over non-tribal businesses, such as gaming facilities and other enterprises, which are required to comply with state regulations and pay taxes. Many of these businesses face an uphill battle competing against tax-exempt tribal operations. This creates an unfair business environment and discourages economic growth outside of tribal lands.

While I support tribal sovereignty and economic development, I believe this bill raises serious questions about accountability. Taxpayers deserve transparency regarding how the Poarch Band’s expanding operations impact our state’s economy, especially when they operate outside the reach of state taxes and regulations. It is important to ensure that federal policies, like S.3263, do not unintentionally harm Alabama taxpayers or local economies.

I urge you to consider advocating for a more balanced approach, such as requiring a state-tribal gaming compact that ensures Alabama receives a fair share of revenue from the Poarch Band’s gaming operations. Alternatively, expanding legal gaming statewide with proper regulation and taxation could create a more equitable environment while generating much-needed revenue for the state.

As a taxpayer, I hope you will carefully consider the broader implications of S.3263 and its potential to create conflicts of interest in Alabama. I urge you to prioritize policies that are fair to all businesses and taxpayers in our state. Thank you for taking the time to address this critical issue, and I look forward to your response.